New taxes in Montenegro in 2025 .

Published

In 2025, significant changes to property taxes came into force in Montenegro, affecting both local residents and foreign investors.

Annual Property Tax

The annual property tax rates in Montenegro range from 0.25% to 1% of the cadastral value of the property. For some properties, such as hotels in tourist areas, the rate can reach 5.5%. The specific rate depends on a number of factors, including the location of the property, its type, year of construction and distance from the sea. Municipalities have the right to increase the basic tax rate by 25%–150%, taking into account local conditions and budget needs.

Property Purchase Tax

Since the beginning of 2024, Montenegro has introduced a progressive tax scale for the purchase of real estate:

For properties worth up to 150,000 euros, the rate is 3%.

For properties valued between EUR 150,001 and EUR 500,000: a fixed amount of EUR 4,500 plus 5% of the amount exceeding EUR 150,000.

For properties valued over EUR 500,000: a fixed amount of EUR 22,000 plus 6% of the amount exceeding EUR 500,000.

These changes are aimed at increasing tax revenues and more fairly distributing the tax burden between buyers of properties of different values.

Tourist tax

In 2025, a tourist tax will also be in effect, the rate of which varies from EUR 0.1 to EUR 1 per day per adult, depending on the municipality. Children under 12 and people with disabilities are exempt from this tax.

Impact on the real estate market

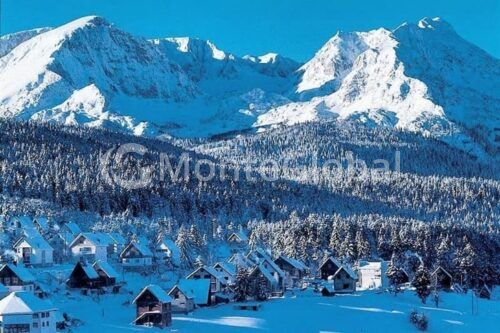

Despite the changes in tax legislation, the real estate market in Montenegro remains active. High demand from foreign investors, limited supply and positive economic expectations associated with the country's possible accession to the European Union contribute to a steady increase in real estate prices.

Thus, the changes in Montenegro's tax policy in 2025 are aimed at optimizing tax revenues and stimulating sustainable development of the real estate market.

Sources